I often remind contractors that the majority of DCAA auditors, their supervisors, branch managers, and on up the chain of command; never stood in the contractor’s shoes. These DCAA employees never sweated a receivable; disputed with a vendor; dealt with the complexity of making a payroll while complying with countless federal, state, and even local compensation laws; or for that matter, few DCAA auditors enjoy the experience of dealing with DCAA.

I said this while reviewing the requirements found in SF 1408 with a new client, specifically:

“2 h. Exclusion from costs charged to government contracts of amounts which are not allowable in terms of FAR 31, Contract Cost Principles and Procedures, or other contract provisions.”.

And

2c. A logical and consistent method for the allocation of indirect costs to intermediate and final cost objectives. (A contract is final cost objective.).

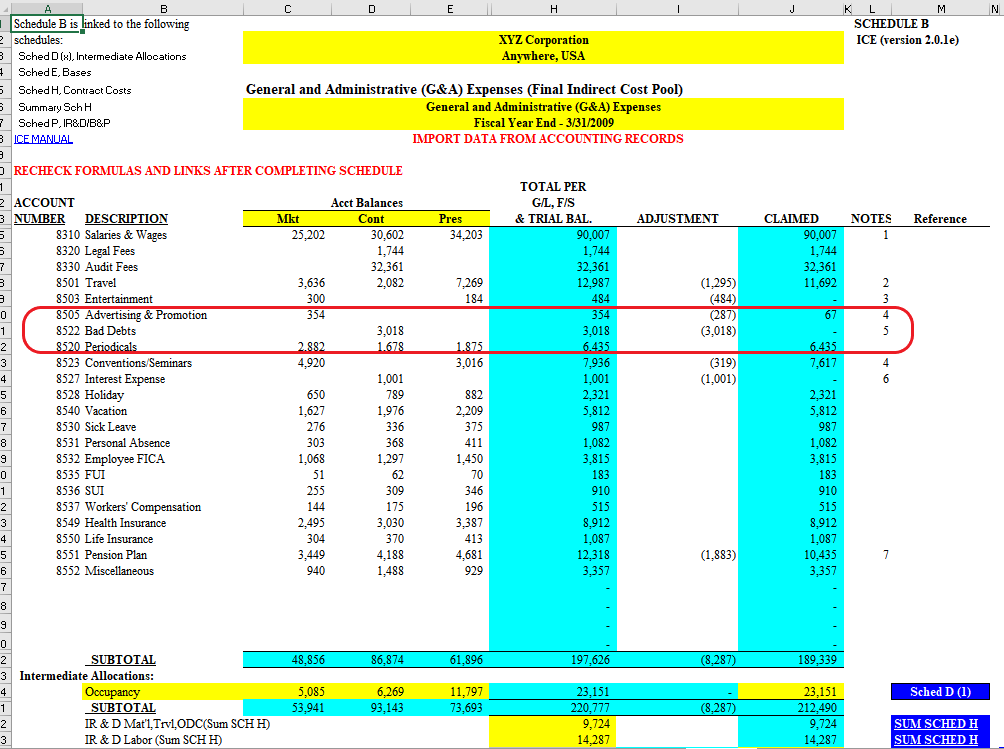

I recommended they move some of their G&A accounts to the end of their chart of accounts to make this easier, focusing on the “Bad Debts” account. I noted that the manual work in identifying the unallowable accounts in reports that the CEO employed was defensible and went into a bit of the history on the adjustment column on DCAA’s model ICE and brought it up on the screen as an example.

Only to discover the Model ICE does not put the expressly unallowable accounts at the end of the Chart of Accounts in the ICE Model Schedule B (G&A Costs)……

Sigh…….