We are now approaching two months attempting to get billing rates approved for an existing small business contractor. We made a previous request to update the 2018 rates in September 2018 but, despite DCAA’s written assurance it was getting looked at, we never heard back from them.

Maybe this email from DCAA and the worksheet they sent illustrates the problem:

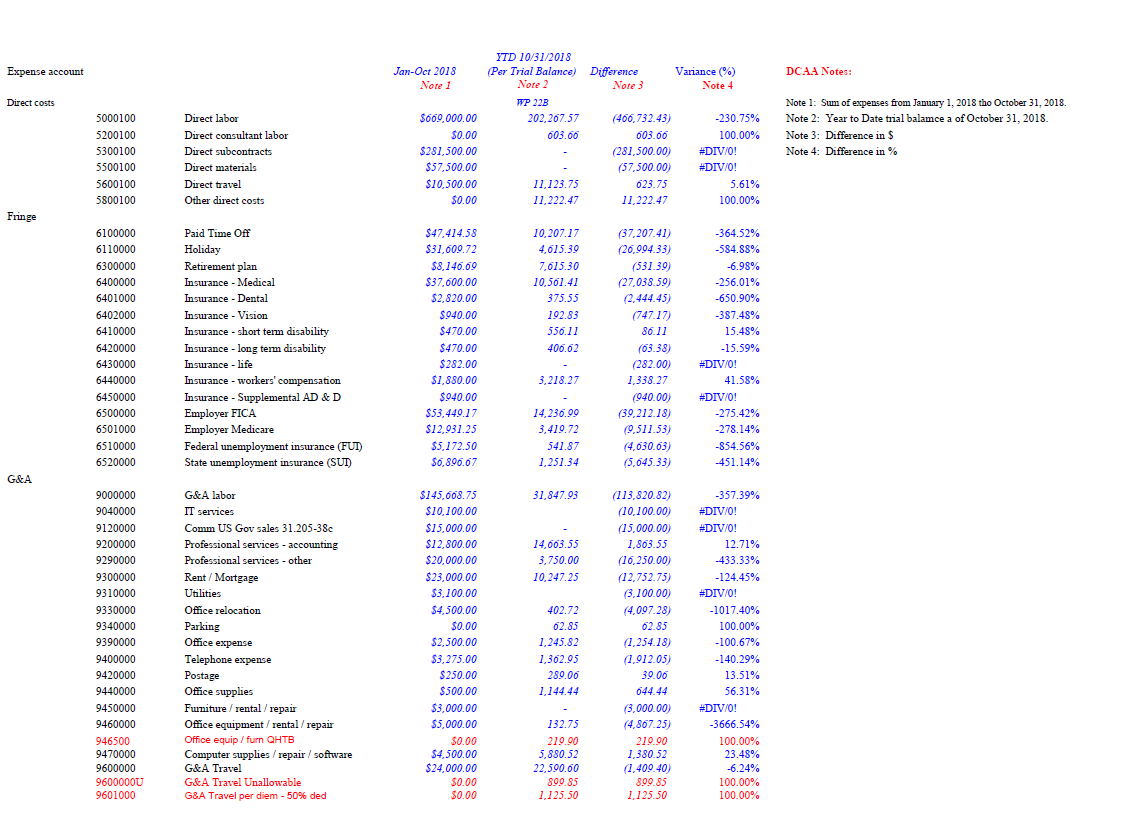

Good Morning, We noted material variances on multiple GL account when we were reconciling the Trial Balance as of October 31, 2018 to the sum of expenses form January 1, 2018 to October 31, 2018 in the expenses tab of the PBR submission.

The expenses tab should be the basis of the assumptions tab right? If yes, please provide DCAA explanation of the variances. (Please see attached)

Here was my response:

As noted in the original request, CONTRACTOR provided a 2019 forecast on December 5, 2018 labeled “CY19 Forecast” along with a narrative addressing the anticipated changes in 2019. The documents provide the basis for the rate proposal request.

The trail balance was subsequently requested by DCAA and provided by me. Although I would not presume to speak for DCAA as for the reason for the request, I assumed that it was to compare the historical data to the forecasted data. As noted above, we provided a narrative with the forecast.

The document DCAA created and attached to your email contains an error that, again I am assuming, contributed to the problem. DCAA labeled the first column “Jan-Oct 2018: Note 1” and the note states “Note 1: Sum of expenses from January 1, 2018 tho October 31, 2018” (SP DCAA). This is inaccurate as our document is clearly labeled “CY19 Forecast”. The numbers are not 2018, but part of the 2019 forecast.

This reason alone, would appear to address the questions you raised in your email, but we stand ready to address any further questions and support your efforts.

Please do not hesitate to contact me with any further questions or comments,

Steve

For some reason, this email generated a quick call from DCAA in which the senior auditor argued that no one ever submitted a “ground up” (what we call in accounting “zero based”) budget worksheet and only utilized incremental budgeting based on the most current historical data.

I responded by noting that zero based budgeting was a common and perfectly acceptable method of budgeting, that we had disclosed the approach we were utilizing, and that I surprised that she had not seen SBIRs utilize zero based.

We concluded with an agreement that the contractor’s approach was valid and, at the moment, nothing else was required. We received a notice last week that the auditor passed the rate proposal on to a supervisor for review.