It is a little bit more than the forest and the trees. Excellent cost management also invoices the relationship between the forest and the tress.

I often focus on variances in government cost type contracts. The variance is the money the government owes you (underbilling) or the money you owe the government (overbilling). The variance is based on the difference between your actual rates and the billing rates. No one wants to owe the government money or do they?

Let’s take a contractor with two government contracts and commercial work. One contract is a cost type contract and the other is a fixed price. Our model contractor is billing indirect costs at 45% of direct costs but is currently spending only 35%.

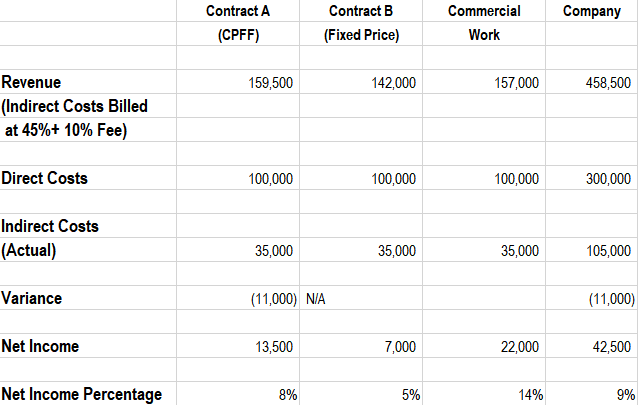

Here is a cost report for the cost type contract at midyear accounting for variance:

| Contract A | |

| (CPFF) | |

| Revenue | 159,500 |

| (Indirect Costs Billed | |

| at 45%+ 10% Fee) | |

| Direct Costs | 100,000 |

| Indirect Costs | |

| (Actual) | 35,000 |

| Variance | (11,000) |

| Net Income | 13,500 |

| Net Income Percentage | 8% |

Remember the 10% fee is on costs, not revenue. That is why the net income percentage is different.

At the moment the contractor owes the government $11,000 due to the difference in the billing rate (45%) and the actual rate (35%). They can entertain several choices: 1) they can ignore it and pay the government back, 2) they can go back to the government and lower their billing rate, or 3) they can try and spend more money or indirect as obviously they had planned to do in the first place.

Most contractors tend to look at choice 3 and start looking on Amazon for that new laptop.

But wait, lets throw the rest of the trees into the picture, the fixed price contract and the commercial work:

We do not have to worry about variances on the other contracts and we have a company wide profit of $42,500 or 9%.

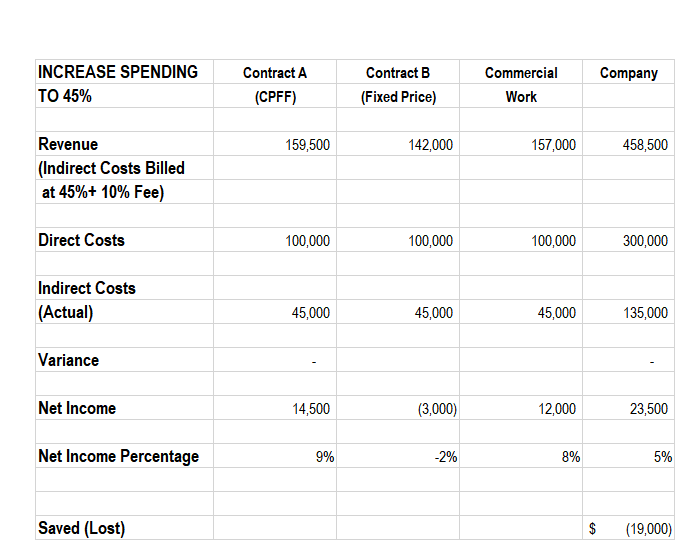

Now let look at it if we raise the spending to the 45% billing rate (I am using same number to ease the illustration process)

Wait a moment, we no longer owe the government the $11,000; but our net profit dropped from $42,500 to $23,500, a reduction of $19,000. Plus, the Fixed Price contract is now running at a loss.

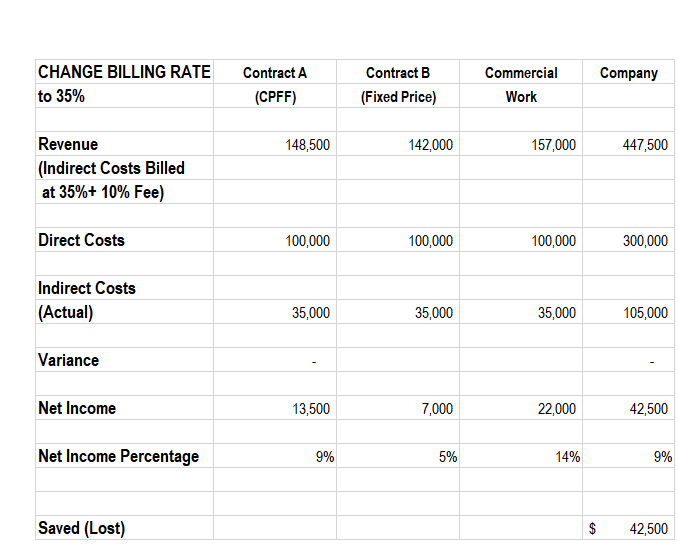

Of course, if we lower or billing rates, the variance disappears, and net profit remains unchanged:

The point is not to go one way or the other. The point is to have the data to make the best decision for your company. Spend more if you need to, lower your rates, if you wish, but be in control.